After months of examining the health of Vashon’s fire department, Chief Charlie Krimmert made the precarious nature of the district’s finances clear last week.

“If we do nothing, you are going to have to go for a levy in 2018 or face bankruptcy,” he told the department’s commissioners.

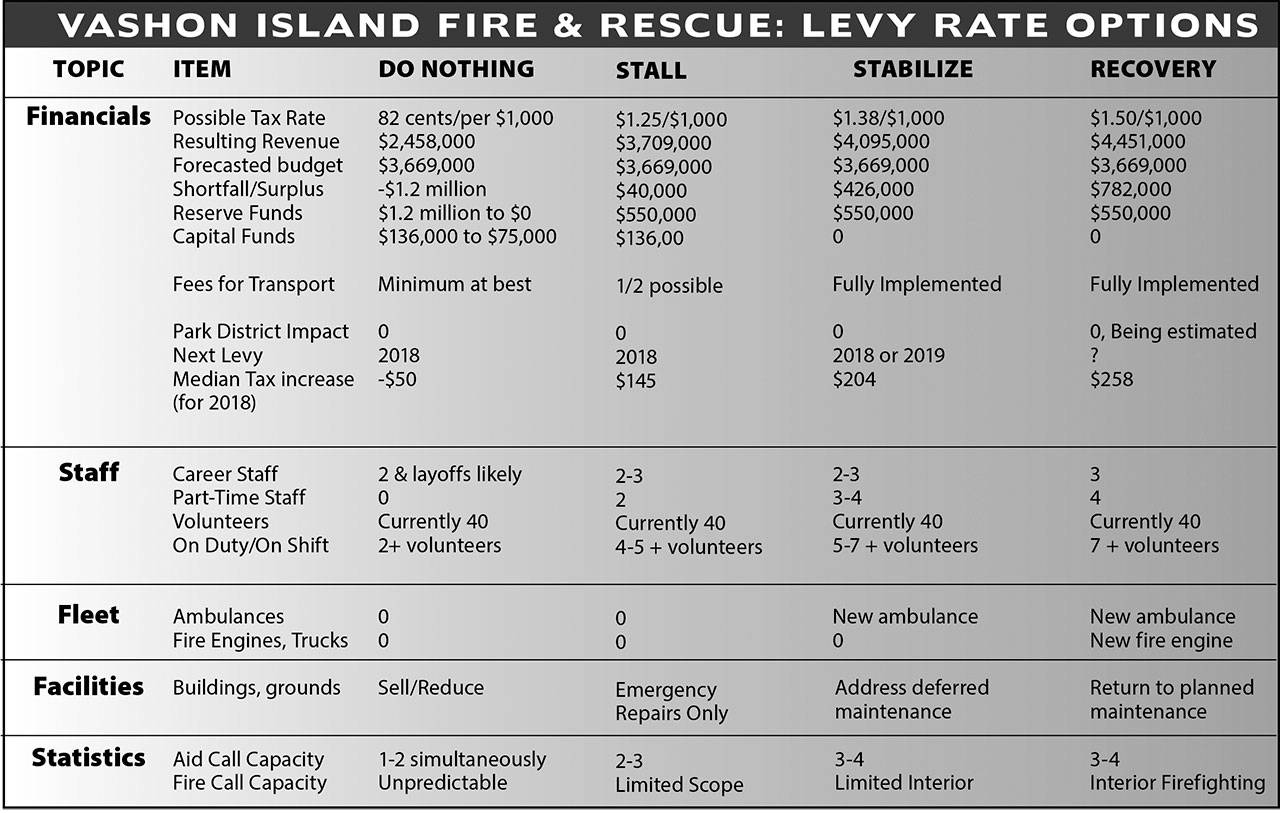

The June 27 meeting, attended by several members of the fire department, Vashon Park District leaders and a few concerned citizens, was the culminating presentation in Krimmert’s state-of-the-district series. He set out several scenarios for the commissioners to consider before the Aug. 1 filing deadline for the November ballot, regarding a potential levy rate increase. The options included the financial and emergency response implications of four possibilities he termed “do nothing, stall, stabilize and recovery.”

The choices range from requesting no additional funds — a measure Krimmert called not an option, but a benchmark — to raising the district’s levy rate by 57 cents, from the current 93 cents per $1,000 of assessed home value to $1.50, the maximum amount the district can ask for. The commissioners voted to hold two special meetings before their next regular meeting on July 11. One has already occurred, and board members are encouraging the public to attend as they consider how best to move forward. Commissioners will likely address various island groups this month and will host a larger community forum, according to Camille Staczek, the current chair of the fire board. She said she wants to know what islanders want to spend — to hear what they believe fire and emergency medical services are worth — before making a decision.

Whatever the board decides, it is expected to fall along the continuum of options Krimmert set out last week.

Do Nothing

Without increased funds next year, the district would face a $1.2 million shortfall, Krimmert estimated, with tax revenues of $2.5 million for a budget of $3.7 million.

Such a situation could have far-reaching implications, as responses to emergency medical calls and fires would be limited.

“If we do not go to a levy, we probably would stay at two firefighters (on shift) and probably start looking at layoffs,” Krimmert said.

Union leaders have raised concerns about the two-person staffing model, saying that they believe working with such small numbers — as they sometimes do now — is unsafe for them and the community.

The proposed new program to pay part-time firefighters — meant to help address the staffing problems — would also be in jeopardy, Krimmert added. Although funds from the district’s new fee-for-ambulance transport program will help projected income, it is not sufficient to cover the whole cost.

Moreover, the small number of district volunteers is also problematic. Currently, VIFR has 40 volunteers, 19 of whom live on the island, with nine serving as firefighters or emergency medical technicians (EMTs) and the remainder as support personnel.

“We depend a lot on those, but their numbers are insignificant to impact a lot of things,” Krimmert said.

In the “do nothing” scenario, the district would be able to respond to only one or two emergency calls at a time — and calls frequently come in clusters, with simultaneous calls occurring more than 100 times a year. Because fighting fires is a labor-intensive endeavor, Krimmert said the district’s response to fires would be “unpredictable,” with the possibility of not having enough of a crew to even begin to fight a fire defensively — meaning from the outside and streaming water onto the fire.

Stall

In this option, the levy rate would increase to $1.25, which is estimated to bring in $40,000 more than budgeted expenses.

There would be two to three paid staff working at a time, and the part-time paid program could provide two additional firefighters each shift, giving the district, with volunteers, the ability to respond to two or three calls at once. As in the first option, the district would likely need to sell some of its facilities; it would make only emergency repairs to its buildings. The district’s firefighting capabilities would have a “limited scope,” which Krimmert termed “a step up from unpredictable.” Still stressing that large numbers of people are important for firefighting, Krimmert said if just three firefighters arrived at a house fire and learned of a trapped child — a plausible scenario — the crews would focus only on saving the child, not extinguishing the fire.

“That is all they are going to worry about, and the house fire is going to get bigger,” he said.

Stabilize

At $1.38, the district’s finances and services would begin to stabilize, Krimmert said, and bring in $426,000 more than the predicted budget. The ambulance fee-for-transport program could be fully implemented at this level — because there would be adequate staff — as many as seven, plus volunteers — to leave the island to take people to the hospital and not transfer their care to a private ambulance company. The district could purchase a new ambulance, replacing the current lead vehicle, which has 105,000 miles on it, and address deferred maintenance on its buildings. It could respond to three to four calls at a time and do “limited interior” firefighting.

“Now we are getting into the game,” Krimmert said at the meeting. “That is one of our aspirational goals.”

Recovery

With a levy rate of $1.50, tax revenue would bring in $782,000 more than the budget, allowing the district to fund some its reserve accounts and purchase a new ambulance and fire engine. It could return to a planned maintenance schedule for its buildings and respond with seven full- and part-time staff to three to four calls at a time and do full interior firefighting if needed.

Krimmert said he favors this level, as it would enable the district to plan for the future, which has not occurred in recent years. For islanders with homes assessed at the median value — currently $452,000 — he estimated they would pay an increase of $258 annually.

Choosing a levy rate for the community to vote on is a board decision, which he addressed last week, saying he wanted the board to fully consider their choice.

“I want to do it with great diligence and great dedication to the need,” he said. “That was the purpose of the last five months of my life, to figure out why we need what we need.”

One of the potential complicating factors is that increased revenue for the fire district could mean decreased revenue for the park district, as previously reported.

State law sets the taxing limit for cities, counties and most special districts at $5.90, with counties and the county road levy receiving a set amount of that sum. So-called junior taxing districts — such as fire, parks and recreation and cemetery — receive the remainder. If that $5.90 limit is exceeded, the law calls for prorationing — or reducing what some of the junior districts receive.

Krimmert said that using projected 2018 numbers, his

calculations show that there is room within the $5.90 limit for the fire district to ask for the full $1.50 and not affect the park district. However, the assessor’s office will not be able to confirm his numbers until after the Aug. 1 filing date.

The park district’s director Elaine Ott-Rocheford has expressed concern, both at the meeting and afterward.

“I am supportive of them moving up, but $1.50 scares me,” she said.

She noted that using 2017 figures — which she stressed will change for 2018 — the park district would lose 3 cents of its current tax rate if the fire district were to take the full $1.50. That would result in a $75,000 cut to the park district, or 6 percent of its budget.

“That is pretty substantial,” she said. “That is a big deal to us.”

Ott-Rocheford added that she has other questions and concerns.

King County is allowed $1.80, but is currently taking $1.24. Even a small jump on the part of the county could affect how much cushion there is before the $5.90 limit is met, she said.

“If the county goes up and Fire has taken most of the wiggle room, that could really hurt us,” she said.

Voters approved a rate of 50 cents for the park district, but next year the rate is projected to be at 42 cents — a reduction because of the increase in assessed property values. If the park district wants to return to its 50-cent rate or ask for its 60-cent maximum in 2019, she does not know yet if it could do so with the maximum increase for VIFR.

“If the fire department takes most of the cushion, what will our ability be to recoup what we are entitled to?” she said. “We are concerned we will be stuck with limited levy funds.”

Both Krimmert and Ott-Rocheford said that some of these questions should be resolved soon, as a critical employee in the Assessor’s Office has been out on an extended vacation and is due back this week.

Another potential complicating factor arose last Friday, with the finalizing of the state budget and the accompanying new emphasis on property taxes to fund education. Because of this change, property taxes on Vashon are expected to increase $630 by 2021. On Friday afternoon, Krimmert said the development was too new for him to comment on, and that he would begin fact-finding in order to forecast its potential effects. Chair Staczek said the board, too, would evaluate the development and take it into consideration.

Commissioners encourage the public to attend upcoming meetings; the next meetings is at 7 p.m. tomorrow, Thursday, at the Penny Farcy Building.