What’s on the agenda for Washington’s 2026 legislative session

Published 12:45 pm Monday, January 12, 2026

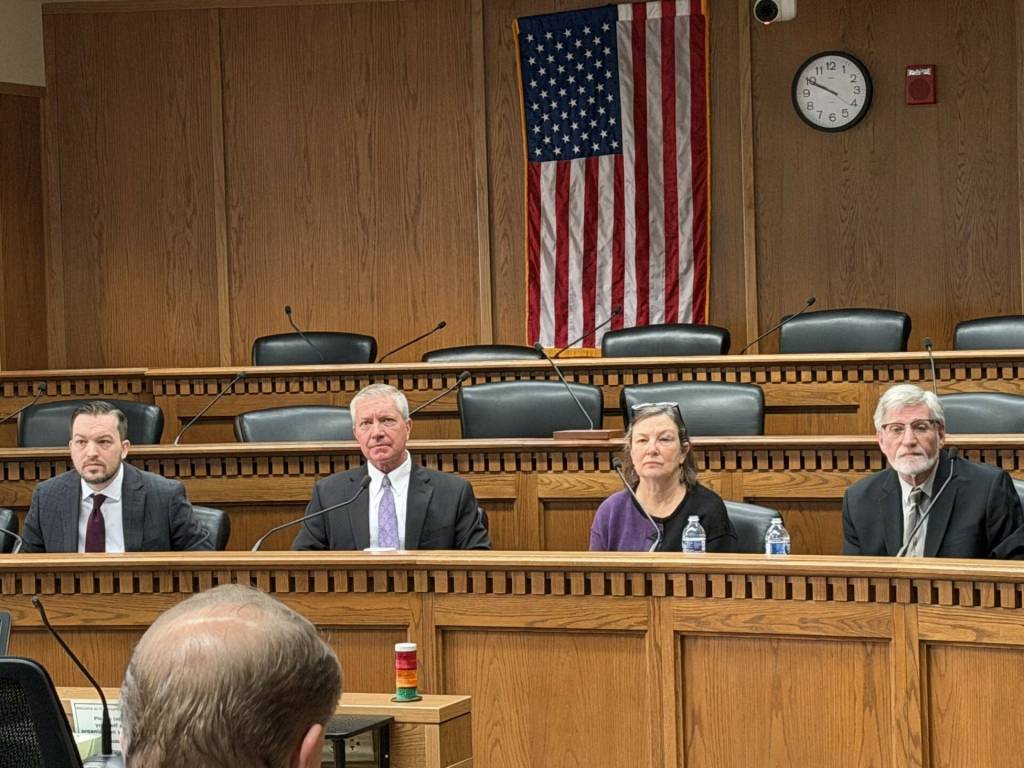

With a looming $1.6 billion to $2.3 billion budget shortfall hanging over the Washington state legislature, House and Senate leaders and Gov. Bob Ferguson presented differing proposals to address the issue.

Three panels of House and Senate leaders discussed the state’s transportation budget and general fund, while Ferguson renewed his support for a “millionaire tax.”

The biggest proposal to balance the budget was implementing Washington’s first income tax since the 1930s. Referred to as the “millionares tax” by the sponsoring Democratic majority party, this proposal would tax those making $1 million or more per year.

“The focus of the millionaire’s tax is really to address our regressivity in this state and to start shifting to make our tax structure more fair,” said Rep. Laurie Jinkins, D-Tacoma, the speaker of the House.

One concern brought up by Rep. Travis Couture, R-Allyn, and Sen. Chris Gildon, R-Puyallup, was whether the tax would cause a “capital flight” in which wealthy Washingtonians would move to other states to avoid the increased taxes. Couture said this could drive out innovative leaders of Washington.

Ferguson reaffirmed his support for a millionaire’s tax in Washington, saying he is confident the tax will survive the legal challenge presented against it.

Ferguson also expressed he is not concerned about the possibility of such a tax driving innovators out of the state, instead highlighting that the tax will benefit Washington residents.

“It’s got to be targeted [so] that we know where these dollars are going, and they’re helping out Washingtonians,” Ferguson said.

Republican leaders’ other main concern is that the millionaire’s tax would eventually become a tax on all.

“First it was tax the billionaires, now it’s tax the millionaires, and tomorrow it’ll be tax the thousand-aires,” Couture said.

Bridge and road maintenance

The panel discussion on the transportation budget focused on plans for maintenance and preservation of bridges and roads across Washington. Severe flooding in December and damage over time brought heightened urgency for a more effective transportation spending policy.

There are also plans to improve and electrify the ferry system. The ferry system faces hundreds of millions of dollars in deferred maintenance and an aging fleet. Gov. Bob Ferguson’s supplemental budget proposal includes $1 billion to build hybrid electric ferries and $150 million for ferry maintenance.

Legislators disagreed on where the money should come from to repair state transportation infrastructure.

Rep. Jake Fey, D-Tacoma, chair of the House Transportation Committee, and Sen. Marko Liias, D-Edmonds, chair of the Senate Transportation Committee, discussed how funds for maintenance and preservation of bridges, roads, and ferries should come from the increased gas tax. They said they want to ensure money does not dip into funds needed for other projects.

A major point of contention was whether Washington should borrow money through bonds to accelerate repairs, which was proposed in Ferguson’s budget. Liias and Fey supported borrowing as a way to quickly address critical infrastructure needs if there is likely long-term efficacy, while Sen. Curtis King, R-Yakima, and Rep. Andrew Barkis, R-Olympia, oppose increasing debt and insist current revenue sources should be reallocated to cover repairs.

Democrats emphasize the urgency of repairing this infrastructure, rather than starting new projects. Due to the complicated nature of these projects, Liias emphasized that it is important to stay ahead of their maintenance and preservation. They also hope to work closely with the Washington State Department of Transportation to increase efficiency and expedite the projects.

“If the Governor’s proposal is to use bonded funds to replace old bridges we have seen fail us in the last year … then I think there may be value in taking a look at that,” Liias said.

King, the top Republican on the Senate Transportation Committee, and Barkis, the top Republican on the House Transportation Committee, say the funds should come from the Climate Commitment Act (CCA), which aims to reduce greenhouse gas emissions.

They argued that revenue from the CCA should be used to help repair storm damage and transportation infrastructure. Liias and Fey countered this, saying CCA funds should only be used for projects that directly reduce emissions, and oppose redirecting the money to roadwork.

Relief and affordability

During the legislative leadership panel, both Jinkins and Sen. Jamie Pedersen, D-Seattle, the Senate majority leader, said they plan to push back on federal government’s policies that target vulnerable groups and hurt the state’s economy.

“We are going to do everything that we can to protect people in our state from a really malevolent, hostile federal government,” Pedersen said.

Rep. Drew Stokesbary, R-Auburn, the House Republican leader, and Sen. John Braun, R-Centralia, the Senate Republican leader, instead argued the current affordability crisis in Washington is not a result of the federal government’s policies. Stokesbary said the way to provide relief for Washingtonians is through reducing sales taxes.

Both Stokesbary and Braun also said they agreed with Ferguson’s proposal to redirect funds from the CCA into the Working Families Tax Credit program.

According to Pedersen, while this plan isn’t ideal, the legislature will have to make difficult choices in the coming session.

–

Previously, this article referred to the budget shortfall as between $12 and $16 billion, as plugged last session. The estimated budget shortfall for the 2026 session is between $1.6 and $2.3 billion, with the lower number attributed to a recent statement from Governor Ferguson.

–

This story is courtesy of the Washington Newspaper Publishers Association (WNPA) Foundation. To learn more, go to wastatejournal.org.