As the already-older population of Vashon ages, many of us will find that we need the services of a caregiver to enable us to continue to live at home.

Fortunately, Vashon Care Network, a nonprofit focused on supporting professional caregivers, is an excellent source for referrals and resources, at vashoncarenetwork.org.

For years, many Vashonites have been paying caregivers as if they were independent contractors. However, by definition, caregivers who provide services in the home are considered household employees by the Internal Revenue Service.

If you need a caregiver, you already have enough challenges without inviting an audit. Yup, if the IRS finds that you failed to withhold the employee’s share of Social and Medicare (7.65%) from the caregivers’ hourly wage, you will be liable not just for the employer’s half of Social Security/Medicare but for both halves (15.3% of wages), plus penalties and interest.

To be fair all around

If you have been paying a caregiver $35/hour (for example) as an independent contractor, you will need to lower the hourly rate by 10% to $31.50 to come out approximately the same after you cover the employer’s share of Social Security, Medicare, and federal/state unemployment tax.

With everything else you’re juggling, you will probably want to hire a payroll service and make one payment to the company to pay your household employees.

Being treated (properly) as an employee is also to the caregiver’s advantage. The last thing caregivers need is a large, unexpected tax bill at the end of the year when they realize the implications of being (improperly) treated as an independent contractor.

The caregiver’s annual take home will come out approximately the same because they will be only paying 7.65% Social Security/Medicare instead of the full 15.3% as an independent contractor, and paying less tax on the lower gross income.

In addition, caregivers who are properly treated as employees will be eligible for unemployment benefits from Washington State if there is a gap between jobs.

Speaking of taxes

IRS Free File is a great option for those with less than $73,000 adjusted gross income. For higher incomes, you can purchase a downloadable tax package for $60-$120 from a variety of vendors. If you are at all computer-literate, you can go online and answer the step-by-step questions to prepare and file your taxes.

For more complicated returns, there are several good accounting firms on the Island.

If you need free help with non-complex federal income tax returns and Washington Working Families Credit, send an email to vashonaarp@gmail.com with your name and phone number and an island volunteer will call you back to set up an appointment for Thursday, March 30, or April 6, at the Vashon Lutheran Church, with time slots available between 10 a.m. and 2 p.m., by appointment only.

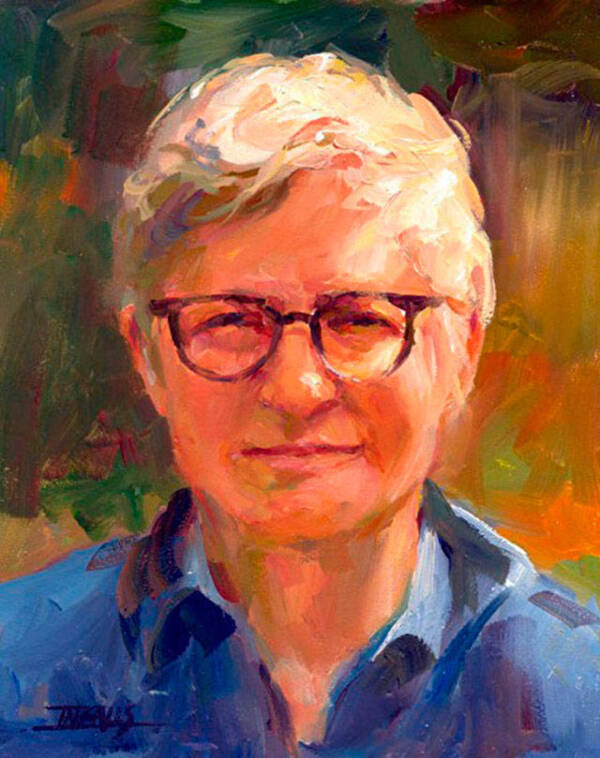

Deborah Diamond is a retired IRS Governmental Liaison who has provided over 1,600 free telephone consultations with islanders regarding stimulus payments, unemployment benefits, etc. through VashonBePrepared and the Vashon Chamber of Commerce’s “Ask An Expert” program. For assistance, contact deborah@vashonbeprepared.org.