Home values on Vashon are down 12.1 percent this year, according to a new report by the King County Assessor’s Office.

But that doesn’t mean your property taxes will drop.

Owners of single-family homes should be receiving revaluation notices from the Assessor’s Office in the mail soon. The new values will be used to calculate taxes due in 2024.

The decline follows two years of big increases in the assessed values of single-family homes on Vashon — 29.1 percent or more in 2022, and 19.7 percent in 2021.

“COVID changed our lives, and it continues to impact the real estate market,“ said King County Assessor John Wilson. “In 2020 and 2021, residential prices and values went through the roof because people chose to not put homes on the market, causing a major imbalance between supply and demand. The housing market is still very healthy, but it cooled considerably in 2022, bringing values down a bit.”

The Assessor’s office is required to revalue each property annually. Vashon’s new home values are summarized in the office’s “area report” for the island, posted online on June 15.

Values for undeveloped residential land on the island are down 9 percent, according to the report. Declines for mobile and manufactured homes vary, but most appear to be in 4 to 5 percent range.

Single-family home values in other parts of the county also have dropped. Declines for areas revalued so far range from 7.5 percent in Burien/White Center to 22 percent in Sammamish.

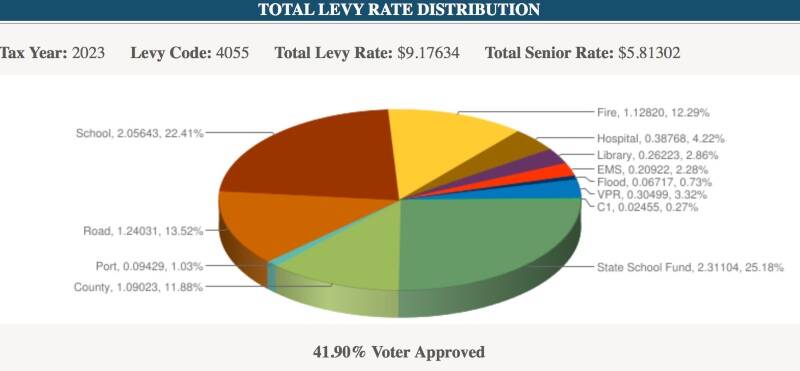

While the assessed value of a property is one factor in determining property taxes, the budgets approved by state, county and local governments have a bigger impact.

By law, those governments can increase their property tax collections each year — 1 percent in many instances, but sometimes more if voters approve.

This year, voters already have given their blessing to two levies that will increase Vashon property taxes in 2024: A new county “Crisis Centers” mental health levy, and a larger levy for the Vashon Parks District (VPD).

In August, voters will decide on two more proposed tax increases: Renewal of King County’s Veterans, Seniors and Human Services levy, and a higher levy for Vashon Island Fire & Rescue (VIFR). (See page 1.)

However, the drop in home values means both VPD and VIFR — if voters approve its “lid lift” in August — will see smaller increases in their tax revenues in 2024 than they likely originally anticipated.

For instance: A South End home, valued at $825,000 in 2022, has been revalued at $724,000 this year.

VIFR’s proposal on the August ballot would increase its levy rate from about $1.13 per $1,000 of assessed value to $1.50.

If that increase passes, the South End home’s owner will pay the fire district $1,086 in 2024. If the home’s value had remained the same rather than dropping 12 percent, the owner’s bill to VIFR would have been $1,238 — $152 more.

Voters will receive their property tax bills next February after all the governments that collect property taxes have adopted their 2024 budgets and levies.

Property owners can find tax levy rates and more property-related information by visiting the eReal Property Search at kingcounty.gov/assessor or by calling 206-296-7300.

Low-income seniors, veterans and disabled homeowners can find out about programs for property tax relief at kingcounty.gov/depts/assessor/TaxRelief.