Vashon homeowners will pay about 2 percent more in property tax this year than they did in 2023.

The annual increase, calculated using reports from the King County Assessor’s Office, is the smallest since 2019. Property tax bills will be mailed and posted online Feb. 14.

County Assessor John Wilson said homeowners elsewhere in King County also are seeing relatively small increases. In some places, he said, residential tax bills are down year-over-year.

On Vashon, the modest bump comes despite voter approval last year of three significant property-tax increases, for Vashon Island Fire & Rescue, the Vashon Park District and a new King County “Crisis Care Centers” mental health levy.

But, counteracting that, Vashon homeowners are being charged less this year for many of the two dozen other state and local levies included in their tax bills – even though, with a few exceptions, those levies are up marginally over 2023.

The explanation: Other taxpayers are picking up more of the tab.

The composition of the county’s, and Vashon’s, tax base shifts a little each year as the assessed values of properties go up and down by different amounts. Last year the Assessor’s Office trimmed the assessed values of Vashon houses by about 12 percent across the board as the once red-hot real-estate market cooled.

As a consequence, other categories of property whose assessed values increased, or didn’t decline as much as residential, are shouldering more of the collective tax burden this year.

The total assessed value of Vashon’s commercial properties, for instance, increased by more than four percent last year. With the double-digit drop in residential home values, that shifted more of the tax burden to the island’s tiny commercial sector.

On average, owners of commercial properties will pay about 21 percent more in property taxes in 2024.

Property taxes are calculated using two variables. One is a property’s assessed value. The Assessor’s office revalued all 700,000 properties in the county last spring and summer.

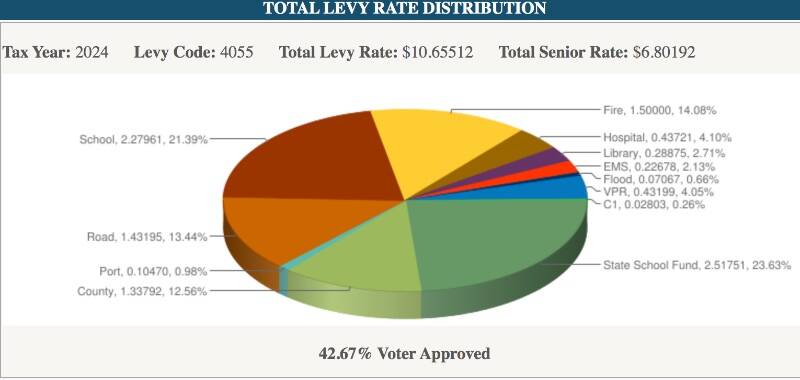

That’s multiplied by the total rate per $1,000 of assessed value of all the tax levies collected in a community. In a report posted Jan. 30, the Assessor’s office supplied the numbers for that half of the equation.

Vashon’s total levy rate this year is about $10.66, up from about $9.18 in 2023. That sounds like a lot. But when that 12 percent drop in residential property values is factored in, it’s not — at least for homeowners.

One example: A Burton-area house whose assessed value a year ago was $933,000, right around Vashon’s median. This year it’s valued for tax purposes at $819,000, down 12 percent.

Do the math: The owners’ property tax was about $8,562 last year. This year it’s $8,727 – up 2 percent.

Taxes on undeveloped residentially-zoned properties on the island are up more than that, about 6 percent. That’s because their assessed values also fell across the board – but by only 9 percent, not as much as houses.

Owners of mobile and manufactured homes, whose property values declined by an even smaller percentage, should see tax increases of around 10 percent.

The 21 percent average tax hike that Vashon commercial property owners face contrasts with the tax cut they enjoyed last year. While the assessed value of the island’s commercial properties increased about 7 percent for taxes owed in 2023, homes jumped 29 percent or more, shifting more tax burden onto the residential sector. Homeowners paid at least 5 percent more tax that year — some paid 10 — while commercial property owners’ taxes dropped an average of 13 percent.

While Assessor Wilson acknowledged that on Vashon this year the decline in residential property values “has shifted the ratio more toward the commercial side,” he said the property-tax burden still falls too heavily on homeowners countywide.

Residential property owners will pay 83 percent of the taxes collected in King County this year, he said, commercial just 17. “That’s not right, it’s not fair and it’s not equitable,” Wilson told a state Senate committee late last month.

He’s backing legislation that would exempt part of an owner-occupied home’s assessed value — in King County, about the first $500,000 — from the state levy that funds schools. That levy accounts for about 24 percent of Vashon property tax bills this year.

Another 21 percent will go to the Vashon Island School District, 14 percent to Vashon Island Fire & Rescue, 13 percent to King County’s countywide levies, and 13 percent more to the county road levy, which is collected only in unincorporated areas. The remainder will be distributed to seven other taxing districts.

Property tax bills also include three county fees — for surface water management, noxious weed control and the King County Conservation District — that are not based on assessed value. For most residential properties, they amount to several hundred dollars a year.

Lower-income senior, disabled and disabled-veteran Vashon homeowners who have received property-tax exemptions will pay a total levy rate of about $6.80 per $1,000 of assessed value in 2024, according to the Assessor’s office. That’s about 36 percent less than the rate other homeowners are paying.

Property owners can find tax levy rates and more property-related information by visiting the eReal Property Search at kingcounty.gov/assessor or by calling 206-296-7300.

Low-income seniors, veterans and disabled homeowners can find out about programs for property tax relief here.

Eric Pryne is a retired Seattle Times journalist.