“In this world nothing can be said to be certain, except death and taxes,” Benjamin Franklin wrote in a letter in 1789. But only one of these has a deadline fast approaching on April 15.

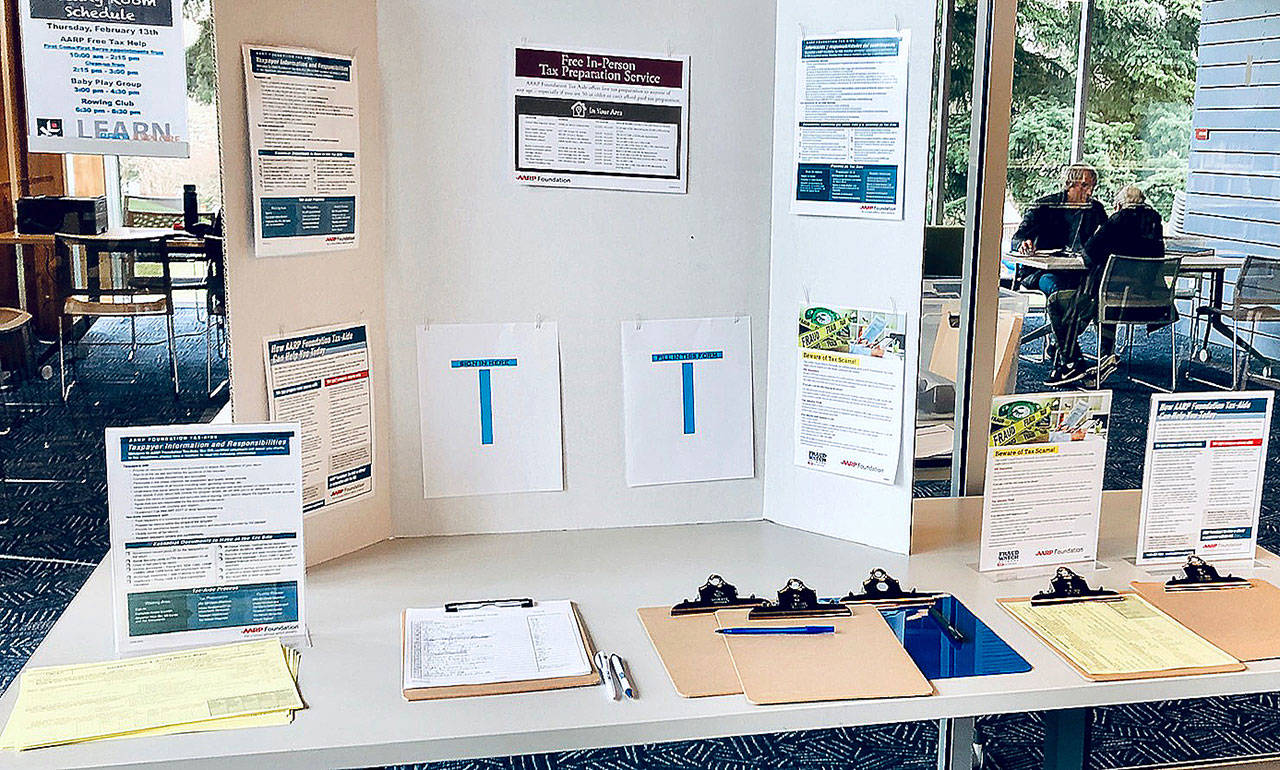

Thankfully, islanders can get assistance through a number of island tax professionals, including a free service offered in partnership between the IRS and the American Association of Retired Persons (AARP). Every Thursday from 10 a.m. to 2:15 p.m. through April 9, volunteer tax professionals can help assist islanders with tax preparation at the Vashon Library.

Erin Rozewicz, the teen and adult librarian at the library, is pleased to have this program available. Even though completing taxes is a requirement, getting them prepared by a professional can be cost-prohibitive.

“Partnering with the AARP Foundation for the free tax help program falls in line with making services accessible for all,” she wrote in an email to The Beachcomber. “This is our main goal as an institution, accessibility. This program makes sure everyone has a chance to have their taxes done by a professional. We all could use a little less stress in our lives.”

The AARP Foundation Tax-Aide program is in its 52nd year and has helped more than 68 million taxpayers, according to the AARP website. The volunteers are trained by the IRS and must pass a course every year to continue to provide tax services.

Laura Griffith, who has lived on the island for 11 years, is one of those volunteers. She has been volunteering with the AARP program for the last three years. When asked why she volunteers for this program, she responded, “Because I can.”

“We are good with numbers; we like doing this stuff,” Griffith said. “It is something we can do without interfering too much with our lives.”

The service is appropriate for any age, although retirees are the predominant usage demographics.

Kerry Fortin, an islander for over 40 years, used the service last year and was one of the people waiting to meet a volunteer preparer.

“I think it is great,” Fortin said. “I wish they had more programs here for people that need it.”

Val Putin has been a “regular” over the past several years in Kent but has recently moved to the island.

“They are so good and they are free,” Putin said. “It would be nice if they had a few more volunteers because the time frame is very short and there are so many people that need their help. It is a great service. I am totally impressed.”

Together these four other volunteers – including one person who worked for the IRS for decades – take their training every year to be recertified to do the work. The IRS provides training with local professionals who are “highly skilled,” according to Griffith. The IRS provides software and computers as well.

Here is what this free service cannot do – complicated tax returns. Complications can be things like married filing separately with money in common or having a rental property.

“There are some complicated things that we are not trained to do so we simply cannot do them,” Griffin said. “Those are the two basic ones that turn up because there are quite a few people on the island that do have rentals.”

For more complicated returns Griffin said, “There are plenty of good preparers on the island.”

Kevin Strel is one of those preparers who deals with complex returns. An islander for the last 20 years, he runs his tax service out of his shop, Spiceberry, in Burton. Strel told The Beachcomber that he starts to pick up by the end of January when early W-2s begin rolling in and doesn’t stop until tax day. He also works with business and corporate returns which are due earlier, March 15. Strel said a complicated tax return can take a few days – some involving several states tax returns.

“And then you do a double-checking that takes time too so I basically do a return twice to make sure it is correct,” Strel said.

What is coming out of left field this year? Not too much. Most of the big changes happened last year with the major tax reform that was enacted in December 2017, referred to as the Tax Cuts and Jobs Act (TCJA) which impacted 2018 tax returns, according to the IRS website.

Strel listed a few of the changes this year. Retirement distributions – required minimum distributions – and homeowner’s property tax income threshold have changed which may affect some retirees and people over the age of 61.

The SECURE Act was signed into law on Dec. 20, 2019, which changes when retirees must take minimum distributions from IRAs and retirement plans, according to the IRS website. For property tax breaks for low-income seniors and people with disabilities, the annual income threshold was $40,000 and that has increased to $58,423 this year. That could impact many on the island said Griffith.

Also, new this year for the upcoming 2020 tax year is the new Form W-4. The IRS has a tool called the Tax Withholding Estimator and the updated Form W-4 to help you check and update your withholding with your employer, if necessary, which will save you from a potentially nasty surprise next April.

Strel told The Beachcomber some tips and tricks – what can you do throughout the year to help during tax season. 1. If you have a small business, don’t wait until the end of the year to do the bookkeeping because people forget. Regularly keep track and it will be easier for you when filing taxes. 2. For individuals who would like to itemize – keep receipts. Standard deductions have changed and many people no longer itemize, but if you have high property taxes or mortgages or medical expenses, it will be worth it to itemize. Keep track of those things all year long.

For a complete list of changes in this tax year and tools to help you determine your tax withholdings throughout the year, visit the IRS website or visit the AARP volunteer professionals at the library to have your questions answered and help with your tax return.

A list of items to bring for tax help at the library can be found on the Vashon library website and include things like social security numbers, last year’s tax return, preprinted bank information for direct deposit of your return, income documents, government-issued picture identification and health coverage information.