I’m guessing that many of you are happy to kiss 2021 goodbye. As you raise a glass to 2022, it’s time to start getting your 2021 ducks in a row so you’re ready to file your federal income tax return … and be done with it!

Here are a few changes of note and some strategies you may want to consider:

1. The special charitable-contribution deduction for 2021 taxes allows single taxpayers to claim $300 of contributions and couples filing jointly to claim $300 each, equalling $600, without itemizing.

2. Unfortunately, the unemployment-income exclusion of $10,200 on 2020 tax returns will not be available for 2021 returns. Anyone who did not have taxes held out of unemployment benefits in 2021 needs to anticipate a potential tax liability.

3. IRS increased the standard deduction and retirement contribution amounts for 2022 to reflect inflation. Based on updated longevity statistics, IRS also increased the number of years of life-expectancy used to calculate Required Minimum Distributions (RMDs) from IRAs and 401(k)s for anyone over 72 years old. If you don’t need all your RMD to live on, look into making a Qualified Charitable Distribution (Not taxed! Full deduction!) or contributing to a 529 college plan for those adorable grandchildren of yours (growth and income are never taxed!).

If your eyes are glazing over at this point, you will be glad to know that free tax preparation will be available at the Vashon Lutheran Church every Thursday from 10 a.m. to 2:30 p.m., starting Feb. 3 and ending April 14. The same friendly, knowledgeable, local assistors who provided this assistance at the Vashon Library for the past several years will be doing return preparation at this new AARP Tax Aide location.

Of course, everything depends on what COVID-19 restrictions are in place during those weeks. For now, the plan is to set up an appointment time for taxpayers to drop off paper tax documents and worksheets curbside, be available by phone for questions, and wait or return 60-90 minutes later to finalize and sign.

The free AARP tax preparation services are available to anyone, regardless of age. However, AARP limits the scope to non-complex returns, including wages (W-2), Social Security and pensions (1099R), unemployment (1099G), dividends/interest (1099INT/DIV), capital gains (1099B), and self-employment (1099NEC) income (no inventory or depreciation). Sorry, no rental income or cryptocurrency transactions.

IRS Free File is still a great option for those with less than $72,000 adjusted gross income. Even though TurboTax has pulled out of IRS Free File, they are offering a free online option for basic returns but only through Feb. 15.

For higher incomes, you can purchase a downloadable tax package for $60 to $120 from a variety of vendors. If you are at all computer-literate, you can go online and answer the step-by-step questions to prepare and file your taxes. For more complicated returns, there are several good accounting firms on the Island.

One final note: You know what they say about death and taxes … both are inevitable. Yes, I’m going to nag you about writing up a will. It’s time to reflect on where you want your remaining assets to go. You can download sample forms to self-prepare or get assistance from a local attorney.

The sooner you get organized, the sooner you can kiss 2021 goodbye!

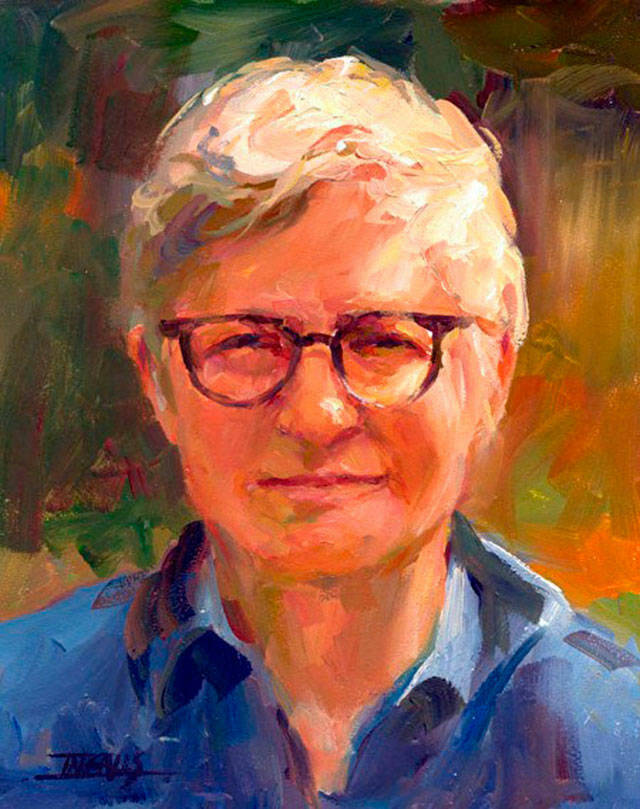

Deborah Diamond is a retired IRS Governmental Liaison who has provided more than 1,600 free telephone consultations with Islanders re: stimulus payments, unemployment benefits, etc. through VashonBePrepared and the Vashon Chamber of Commerce’s “Ask An Expert” program. For assistance contact deborah@vashonbeprepared.org. Diamond’s portrait was painted by Pam Ingalls for her “Local Heroes” exhibit at The Hardware Store Restaurant.