It takes one shot of the Johnson & Johnson vaccine or two shots of the Moderna or Pfizer vaccine to bring about immunity to the virus, but it is the third dose of stimulus that will provide a huge shot in the arm to the Vashon economy.

The American Rescue Plan signed on March 11 directs resources to those who need it most and are most likely to spend it on necessities, thereby stimulating the economy.

- $1,400 stimulus payments are already being issued to each adult and dependent (no age limit this time). Eligibility is limited to single taxpayers with an adjusted gross income (AGI) under $75,000, Head of Household under $112,500, or married taxpayers under $150,000. The phase-out above those income thresholds is much tighter this round ($80,000 for singles, $120,000 for the head of household, and $160,000 for marrieds), so if your AGI is over that amount, you will not get even a partial payment this time.

- The legislation also includes an enhanced Child Tax Credit. It will go from $2,000 to $3600/year for kids under 6 and $3,000 for kids aged 17 and under. There are provisions for parents to elect to receive the credit monthly, starting in July 2021. Procedures will be issued.

- Unemployment benefits, including the current $300 weekly federal boosts, have been extended for another 25 weeks, continuing through the week ending 09/04/2021. This extension should be seamless for ESD to implement so there is no gap in benefits.

- The first $10,200 of unemployment benefits paid in 2020 and in 2021 will be nontaxable. It may be way too late in the filing season for IRS and the tax-software companies to reprogram this change. I am guessing that the IRS will use what is called the math-error process and send a notice showing your additional refund after they remove the $10,200. Bottom line: If you are in a 10% tax bracket, you will get an additional $1020 refunded; 12% bracket = $1224; 22% bracket = $2244. If you have already filed, wait for IRS to issue guidance. If you have not already filed, you can prepare your return but not transmit it until the IRS and the software companies update their software.

There is no COVID-safe way to prepare tax returns in person, so AARP cannot provide free tax assistance at the library this year. If you have a computer and can manage GoogleMeets, you can sign up for an AARP IRS-certified volunteer to coach you through filling out your own return at aarpfoundationtaxaideatp.zendesk.com/hc/en-us/requests/new.

If you do not have a computer or are not comfortable doing your own return, contact me at deborah@vashonbeprepared.org to set up an appointment for free tax preparation via IRS Free File. (If your AGI is over $39,000, you will need to pay for the tax preparation software.) You will read me the numbers from your tax documents over the phone while I prepare your tax return. I will email you a copy of the completed return.

I’m sure you’re more eager to get your vaccine than to get your tax records together, but be brave. You can do this! And then circulate that stimulus money in the community as we hit the road to economic recovery.

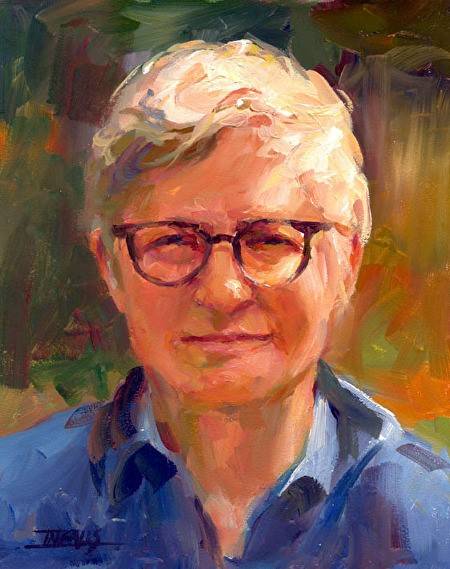

Deborah Diamond has provided over 1,300 free telephone consultations re: stimulus, tax, and unemployment benefits through VashonBePrepared.org and the Vashon Chamber of Commerce “Ask An Expert” program. Deborah can be reached at deborah@vashonbeprepared.org. Her portrait was painted by Pam Ingalls, for her 2020 “Local Heroes” show at The Hardware Store Restaurant Gallery.