Most Vashon homeowners will pay about 5 percent more in property taxes this year than they did in 2022, according to data from the King County Assessor’s office.

Some island homeowners, however, will see a bigger increase — about 10 percent.

Vashon, like much of King County, saw record year-over-year increases in residential property values when the Assessor’s office revalued all homes last year for tax purposes. The assessed values of about two-thirds of island homes jumped 29 percent, while the other one-third were up 35 percent.

This year’s property tax increases are much lower than that, mostly due to limits on how much local governments can increase their property tax collections each year.

Another factor at play regarding island taxation is that unlike in some previous years, voters last year approved only one, relatively small tax increase that is collected on Vashon — King County’s Conservation Futures levy, which uses property tax dollars to protect rapidly disappearing open space, farmland, forests, salmon habitat, and more, throughout the county.

Property tax bills will be mailed in mid-February.

The Assessor’s office late last month posted its 2023 levy “rate book,” showing the total rate per $1,000 of assessed value that property owners in each community will pay, as well as the rates for individual levies supporting schools, fire protection, parks and other government services.

The Beachcomber used that data, and information previously released by the Assessor, to calculate this year’s tax increases for different categories of island property.

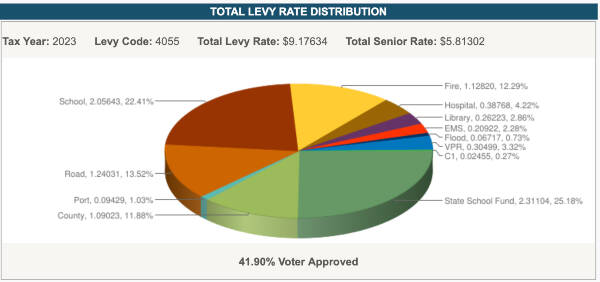

This year the total tax rate per $1,000 of assessed value on Vashon is about $9.18, down from $11.27 last year.

Taxes are calculated by multiplying that total rate by a property’s assessed value. With the new rate, owners of most Vashon homes, whose assessed value is up 29 percent, will pay about 5 percent more tax in 2023 than in 2022.

About one-third of island homes, classified by the Assessor as Construction Grades 8 and 9 — above average, but not mansions — saw their assessed values increase about 35 percent. Owners of those homes will pay about 10 percent more tax this year than last. Owners of manufactured and mobile homes, whose assessed values increased 26 percent, will see property tax increases of about 2.5 percent.

The owner of a typical Vashon commercial property, in contrast, will enjoy a tax cut in 2023. The total assessed value of all commercial properties on the island increased just 6.7 percent last year, according to the Assessor’s office. That was a much smaller increase than residential properties and had the effect of shifting more of the tax burden to the residential sector.

The numbers do not include other charges included in property-tax bills — the largest is the county Surface Water Management fee — that are not based on a property’s assessed value. For most homes, those charges amount to several hundred dollars a year.

About 48 percent of property taxes collected this year on Vashon — $4.37 of the $9.18 per $1,000 — will go to state and local levies supporting schools, according to the Assessor’s rate book. About 13 percent will go for roads in unincorporated King County, 12 percent for other county programs, and another 12 percent to Vashon Island Fire and Rescue.

The remaining 15 percent will be split among the Vashon Health Care, Parks and Cemetery districts; the Port of Seattle; King County’s Medic One and flood-protection programs; and the King County Library System. Lower-income senior, disabled and disabled-veteran homeowners who have received property-tax exemptions will pay about 63 percent as much tax in 2023 as other Vashon property owners, according to the rate book.

Property owners can find tax levy rates and more property-related information by visiting the eReal Property Search at kingcounty.gov/assessor or by calling 206-296-7300. Low-income seniors, veterans and disabled homeowners can find out about programs for property tax relief here.