For the second straight year, a majority of Vashon homeowners will receive slightly smaller property tax bills this year than last.

But a substantial minority — more than 40 percent — will owe about 6 percent more in 2026 than they paid in 2025.

Why? Mostly because their homes are in better shape.

Year-over-year changes in island property taxes were calculated using data from the King County Assessor’s Office, including a report detailing 2026 levy rates that the office released last week. Individual property tax bills will be mailed and posted online Feb. 13.

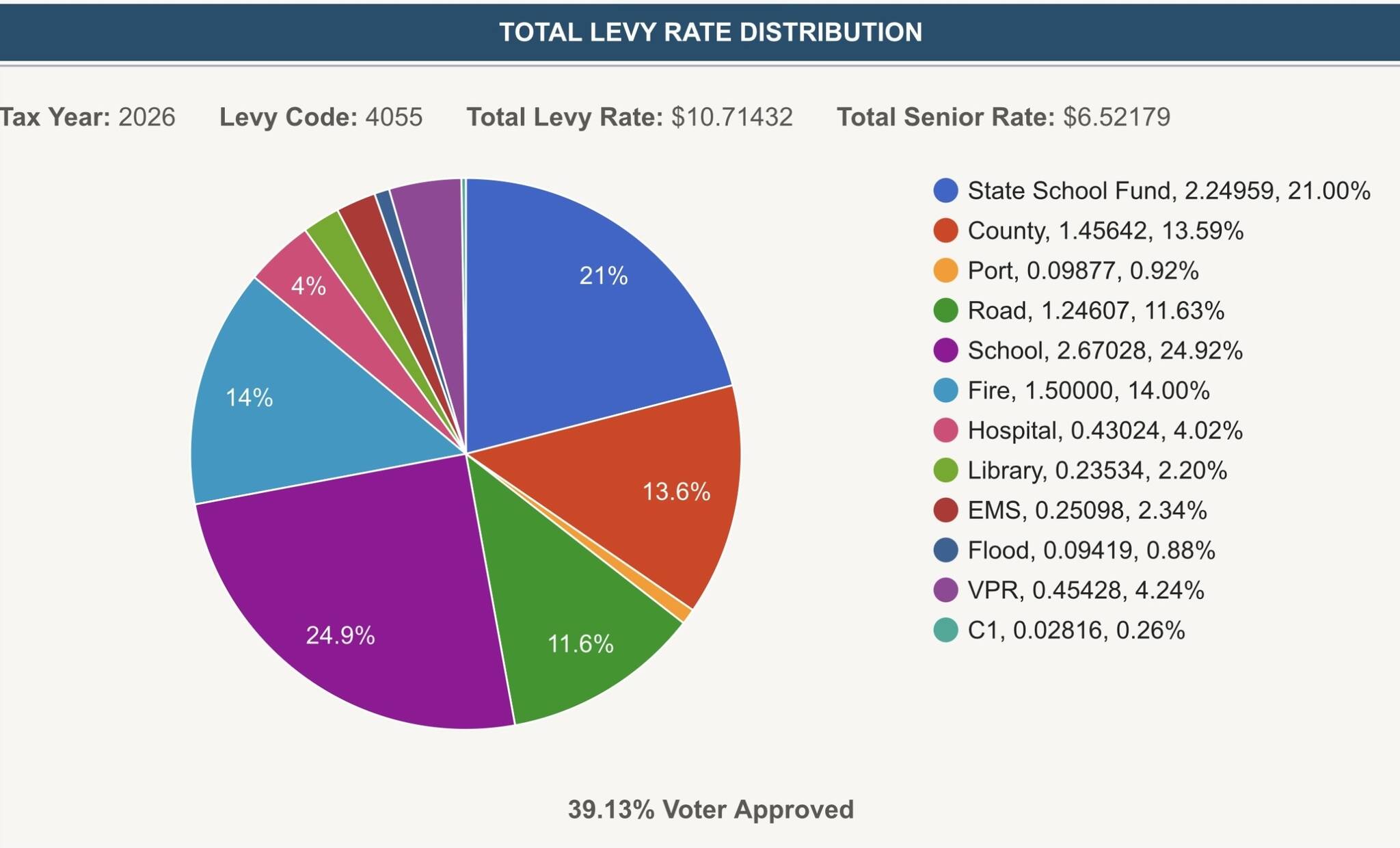

The levy rate Vashon property owners will pay this year is about $10.71 per $1,000 of assessed value, or about $10,710 tax on a $1 million home. That’s up from last year’s $10.39.

But higher levy rates don’t always mean higher taxes; this year is a case in point.

Changes in assessed values also factor into tax calculations. The Assessor’s Office revalues every property in the county annually; it did so for Vashon residential properties last spring.

After analyzing three years’ worth of sales data, the office’s appraisers concluded most Vashon homes’ assessed value should drop 3.1 percent.

But they reached a different conclusion for homes whose condition they had classified as “good” or “excellent.” Those homes — 43 percent of the island’s single-family housing stock — should go up 2.7 percent, the appraisers determined.

So, for example, the assessed value of one Maury island home in “good” condition rose from $777,000 to $797,000. The taxable value of the house next door, whose condition was deemed “average,” fell from $812,000 to $786,000.

The result: Property taxes on the “good” house will go up nearly 6 percent this year, from $8,073 to $8,539. Taxes on the “average” house, in contrast, are down about 0.2 percent, from $8,437 to $8,421.

For that home’s owner, and owners of other houses whose condition is “average” or lower, the drop in assessed value effectively nullified the impact this year’s 32-cent increase in the total levy rate.

Not so for owners of “good” or “excellent” homes, nor for owners of other property types whose assessed values increased even more.

Taxes on undeveloped island residential land are up nearly 10 percent year-over-year. Owners of mobile and manufactured homes are likely to see even bigger increases. For the majority of island homeowners, however, this year’s tiny tax cut follows a decrease of about 1.5 percent in 2025.

Each property owner’s tax bill represents their proportional share of 25 property tax levies — state, county, local — that are collected on Vashon. State law limits most of those levies to 1 percent annual increases in revenue.

But a handful of levies are up significantly more than that this year, and largely explain the increase in the island’s aggregate levy rate from $10.39 to $10.71 per $1,000 of assessed value.

• The rate for Vashon Island School District’s operating levy jumped from $1.03 in 2025 to $1.23. That’s because the Legislature last year loosened limits on how much local levy money school districts can collect, and Vashon voters already had authorized the district to collect more than the previous, tighter limits allowed.

• The King County Council in November increased a levy that supports Harborview Medical Center from 10 cents to 15 cents. The Legislature in 2024 authorized the county to collect up to 20 cents per $1,000 for the hospital without a vote of the people.

• County voters last year overwhelmingly approved renewed, higher levies to support parks and emergency medical services, and, after a one-year lapse, reinstated a small levy for law enforcement’s Automated Fingerprint Identification System.

Property tax bills also include three county fees — for surface water management, noxious weed control and the King County Conservation District — that are not based on assessed value. The surface water management fee, by far the largest, is $379 this year for single-family residential properties, $18 more than in 2025.

Lower-income senior, disabled and disabled-veteran Vashon homeowners who have received property tax exemptions will pay a total levy rate of about $6.52 per $1,000 of assessed value in 2026, according to the Assessor’s Office. That’s about 39 percent less than the $10.71 other homeowners are paying.

Those who qualify for the exemption don’t pay local school levies. They’re also exempted from some state and county levies.

Property owners can find more property-related information, including how their home’s condition is classified, by visiting the Ereal Property search at kingcounty.gov/assessor or by calling 206-296-7300.

Homeowners can learn about programs for property-tax relief at tinyurl.com/wuj2vww9.

Eric Pryne is a Vashon resident and retired Seattle Times journalist.